Large-cap stocks are more frequently traded and usually represent well-established, stable companies. In contrast, small-cap stocks often belong to newer, growth-oriented firms and tend to be more volatile. Let’s explore more about common stock and how it fits into the big picture of a company’s finances. In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends. Otherwise, an alternative approach to calculating shareholders’ equity is to add up the following line items, which we’ll explain in more detail soon.

Flexibility in investment strategies

It is also known as net assets since it is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders. If a company chooses to repurchase some of its common stock, its assets will decrease by the amount of cash it spends even as stockholders’ equity falls by the same amount. The only difference in this case is that the accounting entry for the debit is called “treasury stock.” The inflow of cash increases the cash line in the company balance sheet. To balance out that accounting entry, stockholders’ equity is credited by the same amount.

Preferred Stock vs. Common Stock

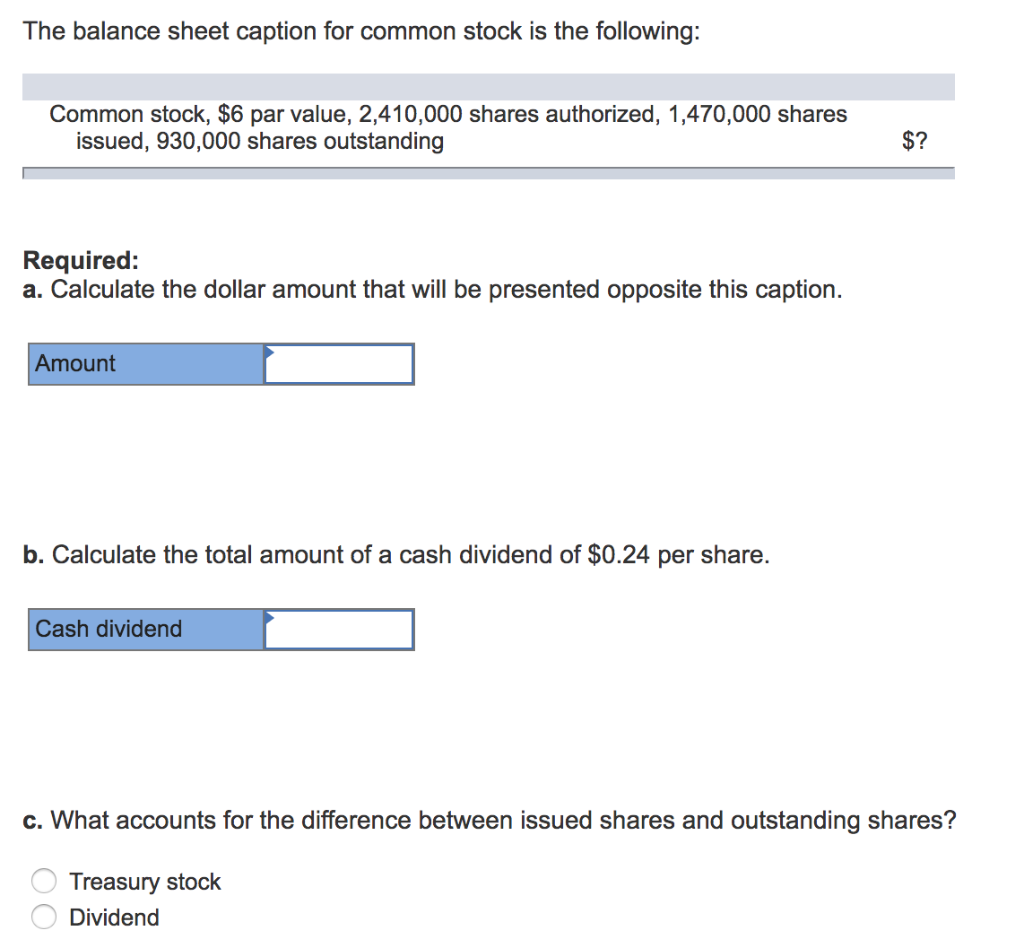

Common stocks are the number of company shares that are found on the company’s balance sheet. Common Stockholders are the company’s owners; they earn voting rights and are eligible for dividends. On a company’s balance sheet, common stock is recorded in the “stockholders’ equity” section.

Understanding Capital Stock

Assets are resources that a company owns or controls and that have future economic benefits. They are typically listed on the balance sheet in order of liquidity, meaning the ease with which they can be converted into cash. Examples of assets include cash, accounts receivable, inventory, and property, plant, and equipment.

Trading and Price Changes

- The current portion of long-term debt represents the amount of long-term debt that is due within one year from the date of the balance sheet.

- The balance sheet is an important financial statement because it provides investors with a snapshot of a company’s financial position.

- The balance sheet shows the company’s assets, debts, and the slices owned by investors (equity).

- When buying a stock, investors don’t have to wonder exactly what type of stock it is.

The snapshot below represents all the data required for common stock formula calculation. Their voting rights allow them to participate in policy decision-making, elect directors, participate in corporate policies, etc. If it is high, it might be pricey; if it is low, it could be a good deal. Equity stock sales represent one of the most common ways for a company to raise capital.

Common stock represents a residual ownership stake in a company, the right to claim any other corporate assets after all other financial obligations have been met. Assets include what the company owns or is owed, such as its property, accounts receivable journal entries equipment, cash reserves, and accounts receivable. On the other side of the ledger are liabilities, which are what the company owes. If a company is healthy, the total assets will be larger than the total liabilities.

The amount of equity to be issued is $3 per share ($2 is the value of the PAR, and $1 is above the PAR). Now that we have an understanding of what shareholders’ Equity is, we can now show the entry of common stock in a balance sheet in the stockholders’ section of a financial statement. Current liabilities are obligations that are expected to be settled within one year. Examples of current liabilities include accounts payable, wages payable, accrued expenses, and short-term debt. The calculation of common stock on the balance sheet is also important for valuing the company. Investors use the information provided by the balance sheet, including the calculation of common stock, to determine the fair market value of the company and its common stock.

Regularly review your portfolio, track your stocks’ performance, and be ready to make adjustments if necessary. Once you’ve found some promising stocks, decide how much money you’re comfortable investing. A good rule of thumb is to invest only what you can afford to lose, especially when you’re just starting. The stock market can be volatile, so it’s wise to keep a diversified portfolio and not put all your eggs in one basket.

Retained earnings are a company’s net income from operations and other business activities retained by the company as additional equity capital. They represent returns on total stockholders’ equity reinvested back into the company. Public companies, on the other hand, are required to obtain external audits by public accountants, and must also ensure that their books are kept to a much higher standard. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report.