This can lead to a situation where reported profits are higher in periods of increasing inventory levels, as some of the fixed costs are deferred to future periods. Conversely, in periods of decreasing inventory levels, profits may appear lower since more fixed costs are being expensed. Inventory valuation under absorption costing can therefore have significant implications for profit reporting and business performance analysis. Using the absorption costing method on the income statement does not easily provide data for cost-volume-profit (CVP) computations. In the previous example, the fixed overhead cost per unit is \(\$1.20\) based on an activity of \(10,000\) units. If the company estimated \(12,000\) units, the fixed overhead cost per unit would decrease to \(\$1\) per unit.

What is absorption costing under GAAP?

Under full absorption costing, variable overhead and fixed overhead are included, meaning it allocates fixed overhead costs to each unit of a good produced in the period–whether the product was sold or not. The treatment of fixed overhead costs is different than variable costing, which does not include manufacturing overhead in the cost of each unit produced. Therefore, to calculate the product costs under absorption cost, the direct materials, direct labor, variable and fixed overhead would be added together to produce the total cost. These costs can also be calculated according to each unit, and this is done by dividing the total product cost from the total unit produced.

What Are the Advantages of Absorption Costing?

Yes, you will calculate a fixed overhead cost per unit as well even though we know fixed costs do not change in total but they do change per unit. When we prepare the income statement, we will use the multi-step income statement format. The absorption costing method adheres to GAAP and provides an accurate, full-cost valuation of inventory.

Understanding Goodwill in Balance Sheet – Explained

As 8,000 widgets were sold, the total cost of goods sold is $56,000 ($7 total cost per unit × 8,000 widgets sold). The ending inventory will include $14,000 worth of widgets ($7 total cost per unit × 2,000 widgets still in ending inventory). For example, if a company offers four products and decides to discontinue two, the two remaining products have to absorb higher overhead expenses. Variable costing illustrates the impact that discontinuing a product has on all costs related to production.

When Is It Appropriate to Use Absorption Costing?

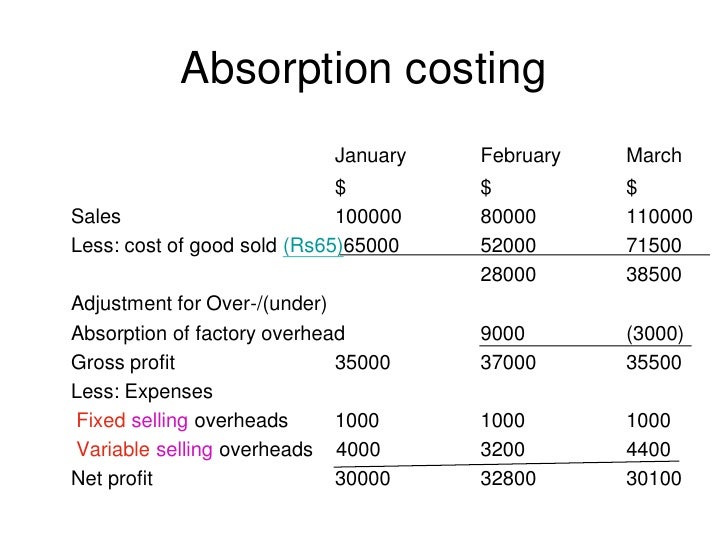

The absorption costing income statement is also known as the traditional income statement. These traditional income statements use absorption costing to form an income statement. Tracking both types of costs allows companies to understand the full cost of production under absorption costing principles aligned with GAAP. It’s also known as complete costing because it accounts for all direct manufacturing costs, including labor, raw materials, and any fixed or variable overheads. Generally accepted accounting principles only require absorption costing for external reporting, not internal reporting.

- Both variables costing and abortion costing may produce different profits due to different inventories valuation techniques.

- Under full absorption costing, variable overhead and fixed overhead are included, meaning it allocates fixed overhead costs to each unit of a good produced in the period–whether the product was sold or not.

- It is very important to understand the concept of the AC formula because it helps a company determine the contribution margin of a product, which eventually helps in the break-even analysis.

- Managers use variable costing to determine which products to offer and which products to discontinue.

- However, absorption-style income statements are required by generally accepted accounting principles.

Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively. It is also used to calculate the profit margin on each unit of product and to determine the selling price of the product. For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). Absorption costing takes into account all of the costs of production, not just the direct costs, as variable costing does. Absorption costing includes a company’s fixed costs of operation, such as salaries, facility rental, and utility bills. Having a more complete picture of cost per unit for a product line can be helpful to company management in evaluating profitability and determining prices for products.

The other main difference is that only the absorption method is in accordance with GAAP. If less than the budgeted units were manufactured, then we would have to add them to the cost of sales. Variable cost Fixed MOH is a period cost and is treated as if it were ALL incurred regardless of the level of production. Costs are separated as variable and fixed (cost behavior) which is helpful for internal analysis. As a result, when using an absorption statement, it is common to find that the expense on the income statement is smaller.

Companies can use absorption, variable, or throughput costing for internal reports. The U.S. Securities and Exchange Commission (SEC) and GAAP are primarily concerned with external reporting. When an opening inventory is bigger than the closing inventory, the outcome would mean that the profits in absorption will be less due to a relatively higher amount of fixed cost in the former. Both variables costing and abortion costing may produce different profits due to different inventories valuation techniques. These profits only differ in the presence of an opening and closing inventory.

This eliminates the distinctions between fixed and variable costs, thereby reflecting the impact of overhead on manufacturing. Full absorption costing–also called absorption costing–is an accounting method that captures all of the costs involved in manufacturing a product. It is to be noted that selling and administrative costs (both fixed and variable) are recurring and, as such, are expensed in the period they occurred. However, these costs are not included in the calculation of product cost per the AC.

Absorption costing is a method in which cost of units produced is calculated as the sum of both the variable manufacturing costs incurred and the fixed manufacturing costs allocated to those units. The absorption and variable costing methods are the two major methods that firms use to increase work value in the process and tax information center finished goods inventory for financial accounting. The variable cost could also be referred to as direct costing or marginal costing, and it includes all variable costs like direct labor, direct materials, and variable overhead. Here, these variable costs are assigned to products and fixed overhead costs for some time.

In this case, the variable rate is $5 per unit and the fixed cost is $112,000. Write your cost formula and plug in the number of units sold for the activity. You can then compare this figure to historical variable cost data to track variable cost per units increases or decreases. Cost accounting provides a company with measurement and allocation techniques to compute a good’s production cost.

.jpeg)